The enclosed information will help you develop the skills and knowledge to create, understand, and run custom scans for technical & fundamental indicators. While reading this guide, we suggest having our scanning tool open in another window to apply the demonstrated steps, which would help you create your unique custom scans.

New! Video Tutorials

More video tutorials by “Fun Techni.”

More video tutorials by “Samco Securities.”

Introduction-

Chartink scanner offers unparalleled flexibility to deliver custom, accurate, and fast stock scans. Chartink’s scanner is a powerful tool that enables you to scan stocks based on the technical levels and indicators you have developed through your experience with stock markets and technical analysis. Some examples of what you can do with the scanner include listing stocks that have crossed the 200-day moving average, have RSI values greater than 70, or have the Highest volume, and many more.

The scanner allows you to customize technical (e.g., RSI, MACD, breakout..) and fundamental parameters (e.g., P/E, book value..) to suit your needs.

Filter components

A scan comprises several filters, which can be added by clicking on the filter icon![]() .

.

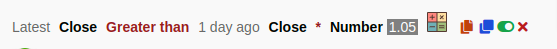

A scan with a single filter appears as follows:

The scan, besides filters stocks whose “close is greater than 500”, notice the interface relates closely to our English language grammar –

Stock attributes

Relates to the open, high, low, close, and volume are always prefixed by an offset that indicates whether you are looking for the current candle Value, a value of the previous candle, or a specific number of candles ago, applies to all timeframes, such as daily, Intraday, weekly, monthly.

Steps performed to add “Close” as a filter attribute. Notice the “Offset” component automatically added.

Offsets

Relate to the timeframe for the indicator for the current or prior candle; often, you’d want to compare the values of a specific component from one day to another, like, referring to the RSI value of today & comparing it against the RSI value 10 days ago.

Offsets allow you to add this flexibility to your analysis, enabling you to compare components from days before the most recent trading day. This can be useful when conducting trend analysis or identifying potential opportunities in the market.

For example, you may want to identify stocks that have closed above their previous day’s close.

Hint: An offset is automatically added once you select a stock attribute or an indicator defaulting to “Latest” (current daily candle). To change, click on it(latest).

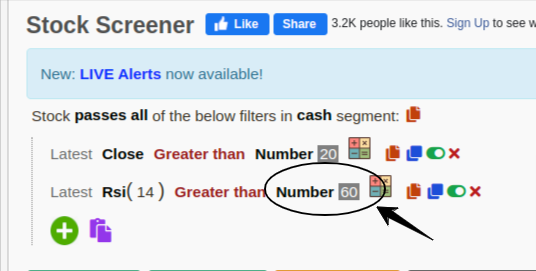

Number constant:

Hard-coded numbers are fixed/constant values. To create filter, you can use comparison operators (like greater than or less than) or math operations (+,-,/,** *) to create a filter.

Indicators:

You can add multiple indicators, such as SMA, RSI, MACD, and ADX, and perform various computations on them to filter stocks.

Most indicators require a parameter for their computations, and Chartink automatically sets a default value for the parameter when you add the indicator (shown in brackets).

You can easily change any indicator’s parameter(clicking on it) to suit your needs.

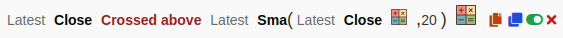

Adding SMA as an indicator(to the first line), notice the parameter for SMA i.e (close, 20), signifying the computations to be on the “close” stock attribute for the past 20 days.

Hint: If an “Indicator” requires multiple parameters, they are separated by a comma, e.g., “(close, 20)” here.

Operations:

After adding a “stock attribute” or “indicator”, you may want to perform operations on them to compare them or use them in your custom criteria. These operations allow you to link indicators and other filter components together to create more complex criteria. For example, you may want to compare an indicator value to a number constant or add two indicators together.

The format for linking operations with other filter components is as follows:

indicator operation(greater than/less than) number constant .... stock attribute operation(equals) indicator .... number constant operation(*, /, +, -) number constant operation(less than) indicator ...

An operation can be performed by clicking on the icon. “Also, multiple operations can be performed for a single filter.

Types of operations:

Arithmetic:

To construct more advanced scans, you can use arithmetic operations (add, subtract, multiply, divide) on filter components. This allows you to create scans for stocks that have gained a certain percentage today (e.g., 5%). The example below shows a scan that uses two operations, one of which is an arithmetic operation (*), to filter stocks that have experienced a gap up or gap down. Here is an example scan.

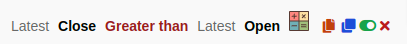

Comparison:

Probably the most common operation you’d use, as every valid scan requires a comparison among 2 filter components. A single filter can have only a single comparison. In the below snippet, the “greater than” operation denotes the relation between the 2 stock attributes(close & open) & filters stocks that have a “Close” greater than a stock’s “Open.”; here is an example scan.

Crossovers:

Often you’d want to filter stocks based on certain breakouts, which can occur when a stock closes below a certain value yesterday but closes above it today (signifying a crossover). [Value here refers to any indicator or stock attribute.] here is an example scan.

The above would filter Stocks that closed below the 20- day SMA yesterday but today it closed above the 20-day SMA (crossing over from below).

Steps to add operations to a stock attribute:

To filter stocks that are closing above 5,000, you can perform the following operation:

Steps to create the scan

- Select the ‘Add a filter’ option from the menu.

- Choose the ‘Close’ attribute from the list of available stock attributes.

- Select the ‘Greater than’ comparison operation.

- Enter the Value of 5,000 in the constant number field.

Multiple Filters & Filter Behavior:

Normally you’d want to have multiple filters specified in a single scan. To add more than a single filter again, click on the filter icon and select a new filter to add.

i.e., You can change the filter’s behavior within a scan to achieve an AND or an ANY condition or even have it fail a certain filter within your scan.

Sub-filters/Grouped filter:

Sometimes it may be necessary to group filters and their behavior to create more complex criteria.

In this scenario, we can see that the main group condition passing is “latest close > 200”. This condition is a must. 2 sub-filters or sub-groups are created after that, out of which the scan passes any 1 of the 2 groups along with the main condition “latest close > 200”. You can see the sub-groups are highlighted and are being passed in a “Passes Any” join.

Scan for EMA 20 with volume OR close crossing EMA 20 where RSI above 70

Functional Filters(Min/Max):

The Min and Max filter components are unique because they accept other filter components as parameters. These functions are useful for calculating the highest or minimum values over a specified number of days. These functions take two parameters, as follows:

- Period – Denotes the periods over which this function shall perform its computations.

- Measure(stock attribute, indicator) – Denotes the measure against which the computation shall be performed.

To identify stocks that have reached their 52-week High on a given day, the Max(period, measure) function can be used.

After selecting this function, its required parameters will be automatically added. These parameters can be modified by clicking on them; in this case, they should be changed to 252 and High.

The measure selected, in this case, High is used to identify stocks at their 52-week High, which consists of 252 trading days.

This allows for identifying stocks that have reached this milestone on the specified day(latest).

Examples with scans –

We’ve compiled a few examples to help you design your custom scans. Click here to view more example scans. You can also browse through the scans created by other users here.

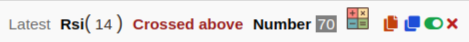

Overbought filter:

List stocks that have RSI(14 days) changed their zone from below 70 yesterday to above 70 today, indicating they are likely to see entering to overbought zone. Here is an example scan.

Oversold filter:

List stocks that have RSI(14 days) changed their zone from above 30 yesterday to below 30 today, indicating they are likely to see entering the oversold zone. Here is an example scan.

Gap-up filter:

Listing stocks with an open greater than 3% of yesterday’s close. If a stock closed at 100 INR yesterday, Its open today should be greater than 103, denoted by “1 day ago Close * 1.03”. Here is an example scan.

![]()

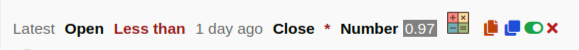

Gap-down filter:

Listing stocks with an open of less than 3% of yesterday’s close. If a stock closed at 100 INR yesterday, Its open today and should be less than 97, denoted by “1 day ago Close * 0.97”. Here is an example scan.

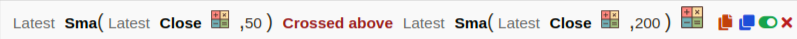

Bullish stocks filter:

Often a crossover of 50-day SMA over 200-day SMA is treated as a bullish signal. Here is an example scan.

FUNDAMENTAL SCANS

Examples and usage of fundamental filters can be found here.

Frequently Asked Questions –

Kindly refer to our FAQ page for further queries. If you have any suggestions/doubts, kindly contact us.

We hope that this guide provides a solid foundation for creating custom scans and helps you make informed trading decisions.

chart ink, require to provide data brake up, like 25 min chart etc

Sir I want ur 25 min data pls contact me at 9510964013

sir please install trand line’s in you’s chartink chart , it will help’s to stocks trand , you should update or install ”trand line ” and also HH AND LL AND HL AND LH ,IN YOU CHART INK THx

Did you mean Trend lines? Also can you give more details on what are you looking for(HH, LL)?

High high and Low Low

Below is an example scan for the same:

https://chartink.com/screener/5-day-higher-high-breakout

Low

When can I get latest screeners before market opens,if I enrol as a paid member.

Stocks making higher highs and LOWER LOWS should be added. similarly higher lows and lower highs need to be added.. also you should add stocks nearing trend line supports and resistances on daily ,weekly , hourly and 15 minutes charts. Also need to know breakouts on trend lines.

We have many scans for this, here’s one on a daily candle: https://chartink.com/screener/5-day-higher-high-breakout

Hi Akash ,Happy to know you are there,I communicated with you about 4, 5 years back.God bless you.

🙂 Hope you doing good. God bless you too..

Hello Akashji, can v talk , not understanding how to set one scanner, pl drop your no on 9769951451 , wl call you

Jitesh M

Mumbai

hello akash

i want to know how to check some condition

for example if my latest candle closes below vwap i want to check if it has macd or sma crossover in the past 15 min anytime in past 15 min . please help

Hello,

Sure, below is an example scan for the same:

https://chartink.com/screener/current-close-crosses-below-vwap-and-previous-candle-either-below-sma-20-or-macd

Hi Akash, could you plz update ‘ZigZag’ for the scanner in order to scan waves (eg., HH, LL) on smaller time frame like 5min, 15min? Or else if there is any other way to scan HH, LL on 5min chart?

Happy for the great effort made so far. The toll is amazing!

Hello,

There are a few scans on the same created by members on Zigzag. You may view them here: https://chartink.com/screeners/search?search_term=ZigZag

trendlyne.com

I want to register with yo0u

As a premium member you would be able to:

Access realtime data for Charts & Scans every minute

Create Alerts and receive updates of stock breakouts over sms/email/mobile/desktop

View charts in 1/2/3 minute timeframes with auto-refresh

Run screeners in 1/2/3 minute timeframes with auto-refresh

Scan any watchlist via the segment dropdown of a scan

Get Dedicated support for your scanner requirements

You can get details/signup our premium service here: https://chartink.com/subscription

Sir today I paid one month subscription fee but can’t understand how to create the filter any can help me my mobile 9903169001

If you need help in creating a scan, please share your requirements and we shall caret the same for you. (email at [email protected])

You may view tutorials on scans and alerts here:

https://chartink.com/articles/scanner/scanner-user-guide/

https://chartink.com/articles/alerts/alerts-guide/

You can also start by reviewing out top scans here: https://chartink.com/screeners/top-loved-screeners

They contain the top 10 scans used for Intraday/Swing & short term trading

is there any open intrest build up scanner for 15 min..

Currently we support only NSE cash stocks and indices. We do plan on adding others in the future. Shall keep you posted.

SIR I WANT CPR NARROW RANGE STOCK PLEASE GUIDE HOW TO SCAN MY EMAIL ID [email protected]

Below is an example scan for the same:

https://chartink.com/screener/nr7-612

Is it possible to create a custom scan and have it auto-refreshed every 15min or 1hr?

Hello,

Currently, auto-refresh is for every 1minute. We can’t change the auto-refresh time.

Want 5 20 ema crossover 5 min time frame

Hello,

Here is your scan for the same. Kindly review:

https://chartink.com/screener/ema-5-crossing-above-ema-20-5-minute-timeframe

how do I set it in mobile

Hello,

We do not have a mobile app (Android or IOS). This is only a web-based application. However, you can access Chartink on your mobile phone via the web browser.

If you are referring to setting up scan or alert in mobile. Below is our YouTube channel. Kindly review.

https://www.youtube.com/@ChartinkConnect

I want to register with you

You can get details/signup our premium service here: https://chartink.com/subscription

I want to find the supertrend breakout for weekly and monthly candles like I do for 30 minutes or 1 hour or daily candles. How do I do it?

Sure, below is a scan for weekly crossover:

https://chartink.com/screener/weekly-close-crosses-above-supertrend

Kindly confirm Need to use “Crossed above” or “Greater than” as Operations. “Greater than” Operation works correct. “Crossed above” missed many stocks.

If you are comparing candles, you need to use greater than/ less than. If you are using it for indicators, then crossover function needs to be used.

Please provide offset parameter for EMA.

Thanks

You can directly plot it ahead of time. Eg: If you’d want to plot/scan with the EMA of a offset of 26 on today’s chart, you can directly do “26 days ago EMA(close,20) less than Latest close”, this ways’ the EMA 20 of 26 days ago, will be compared against the latest close of today

HOW TO GET ema without offset for example ema ( close,5 ) instead of ema(latest close,5 ). Thanks

Hello,

By default, it would always show the offset since we need to specify where to start calculating the EMA. Hence, the “latest” would always be present by default.

I want 20% below from 52week high, how I get stocks,

Hello V P Singh,

Here is your required scanner; kindly review – https://chartink.com/screener/20-below-from-52-week-high-stocks

bulish and nest day

Absolutely marvellous exercise launched by Chartink …….I am regular user of Chartink EOD charts for a long period will absolute comfort…….though I have vaguely understood wht u had conveyed, I would request you to demonstrate each of the options given above by way of an example of real stocks…….that would really help in guiding us…….if u need more people to attend this tutorial online…..there are many many people in my group……pl guide as per yr requirement…..Thanks

Thanks for your feedback. We’ll be soon add video tutorials for better guidance of the scanner

Sir, please give money flow index overbought or oversold

This is same as RSI, you can refer this screener & change RSI to MFI, http://chartink.com/screener/weekly-rsi-overbought-oversold-scan

How this can be helpful to enter & exist from the stock

rsi can not change into MFI please add MFI option like others indicator added in your selector

We do have the MFI indicator. You can choose it from the drop down menu.

Respected sir,

I am a regular user of Chartink EOD charts. I visit daily for research and study stocks. According to me this is best website for investors and traders.

If I run a simple query like “Latest Close Greater than number 500”, nothing happens.

However, when all this starts working, it would be a fantastic tool.

One suggestion: Can you provide a facility to apply these filters to NIFTY stocks, JUNIOR NIFTY Stocks, CNX IT Stocks, etc?

Hello Team

Amazing website. I use it extensively for my research. Keep up the good work!

Dear chartink team !

Thanks a lot for new scanning tool.

My query: how to scan 3 candles at a time(p1, p2, p3) .

example: p2 close price is lower than p1 close price.

p3 close price is higher than p2 close price.

Thanks for your feedback.

I think your query is quite similar to one of our examples, http://chartink.com/articles/scanner/stocks-in-uptrend/

Let me know if that helps

Akash ji,

It works ! Thanks for your quick response.

(Latest Open less than 1 day ago open

1 day ago open less than 2 days ago open

Latest open greater than 1 day ago close

1 day ago open greater than 2 days ago close

latest close greater than 1 day ago close

1 day ago close less than 2 days ago close

latest close greater than 2 days ago close)

2nd query: How to apply this method on weekly & monthly chart for all data?

Currently we scan only on daily data, we plan on adding weekly/monthly data in the month of Feb

Okay akash ji,

Akash ji,

(( Latest Open less than 1 day ago open

1 day ago open less than 2 days ago open

Latest open greater than 1 day ago close

1 day ago open greater than 2 days ago close

latest close greater than 1 day ago close

1 day ago close less than 2 days ago close

latest close greater than 2 days ago close))

This method is working eod, But live it jumps p4 candle, how to resolve this problem ?

I would like to have this method live trade before 3.30 pm.

Hi Mr Akash,

Can you please help us with weekly and Monthly chart scanner?

Regards,

Rangaswamy

P1 is -2

P2 is -1

P3 is 0

-1 close less than -2 close

0 close greater than -1 close

Do you need this scan on daily candles?

hii sir i need your Help please tell me what can i do… i have to set a new scanner so plzz help me for set a EOD scanner,

condition 1 st….. 1st candle made Low, 2nd candle made Low But 3rd candle open and Low Above 1st candle Low minimum 0.05 paisa.

condition 2nd….. 1st candle made high, 2nd candle made high But 3rd candle open and high below 1st candle high minimum 0.05 paisa.

if you available for set this new scanner plzz contact me on my mail id [email protected]

Very good work chartink by providing scanner.. I would like to know is it possible to get sma 50 crossed above sma 200 before market close for the particular day? Because it ll be helpful to do profit book next day early morning

We’re working on integrating the scanner with market hour candles(15 minute delay), it shall be ready to use in the month of Feb’16

Thanks akash ji,

Finally solved my 4th candle jumping issue,

Exciting to wait weekly & monthly chart by chartink scanner!

what is the solution u get it i have the same query

Thank you so much for ur efforts..

Hi Mr Akash,

Can you please update on integrating the scanner with market hour candles as mentined by you above?

Regards,

Rangaswamy

Hi Akash ,I am not able to distingush which set is for bullish and which on for bearish can you pl help me ?https://chartink.com/screener/bullish-sar-ema-crossover-15min

In the first sub-filter where it checks for crossabove, would be to check for bullish stocks. Cross belows would be bearish.

how to scan for weekly chart or monthly chart??? nice work..

Can I scan only Future Stocks, please add 30min and hourly charts data.

IS ANY IMPROVEMENT TO FIND OUT ONLY FUTURE STOCKS

Hello,

You can select the “futures” as a segment in place of “cash” segment from the dropdown list.

Kindly note: Currently, we support only NSE cash stocks. We have only created a segment group called ‘futures’ to scan stocks that are traded in the F&O group. If you select futures, scanning will be done on basis of cash stock prices/ values.

Please add some more features for:

1. Analysis only on index graph not on index listed company for example: nifty 50 index graph not on nifty 50 company.

2. INDEX option chain data Example: first I will select index in which I want to trade then it’s Call /Put option strike and expiry date as well.

3. RSI Divergence in you indicator.

Hello,

Please find our responses to your queries below:

1. Can you please elaborate a bit more on what you are trying to achieve here exactly?

2. We currently support only NSE cash stocks and indices; we have created a segment group named ‘futures’ to scan stocks traded in the F&O group. If you select futures, scanning will be done based on cash stock prices/ values.

3. Do you mean you want a scan to show RSI divergence? Kindly confirm.

Thanx Charting for a valuable software.God always bless u for ur work.

Kindly add buying and selling signal for long term and posional trader.Also another request kindly technical learning guide for new trader.

Thanks once again

Hi Team, Scanner option is good. Is there any option to choose from Daily/ Weekly/ Monthly timeframe? Currently I can see scanning features are available on daily data frequency. For example- Weekly RSI greater than 50.

Thank you.

Hi Chartink team,

Kudos for your work. I have been following chartink for past two years. I have a excellent experience with you. Thank you. Keep it up. All the best for your future endeavors.

How to set scanner for Bullish stock for that particular day.

Eg. I want to see how many stocks closed higher than open.

I tried , latest close, greater than Latest Open.. did not find desired results

Can u add WMA in filter

Can we create our own Watchlist for a scan

We have just added WMA, TMA, ATR & True range within our filter

Hi Team,

I need to calculate the position for parabolic SAR selling or buying position (latest or one day ago) using the scanner to know the trend of the stock. Please let me know how to apply it.

amazing scanner…please extend to weekly,hourly charts.some more indicatorsviz. bollinger bands

etc may be included. can i save my predefined scan parameters?

regards

raju mvs

Very good work.For daily scans on same parameters it would be good idea for the user to save the particular scan so as to save time everyday

Saving custom scans is now possible, click on “Save Scan” on the scan screen to save a scan

hi

still the filter for FnO and the scanner across different timeline charts is pending for update?

These if done would be extremely useful and we are grateful to you for the same.

thanks

Sir, is it possible to scan the stocks which Started reversal movement,if yes please explain the filters.

Thank you

pl. add a feature to run custom scanner on our own watch list .

sir,

I created three scanner in your website all are not working from yesterday pls suggest what to do.Also confirm is this all saved scanner working in market hour

I’m able to view 3 scans that you created,

http://chartink.com/scanner/542

http://chartink.com/scanner/769

http://chartink.com/scanner/935

These scans are running correct and it appears as of today there are no stocks matching your filters(as this running during market hours now). To get the same results as of yesterday, change “Latest” to 1 day ago

thanks akash .pls mention ur twitter account if u use that

Thank you Sir

I am unable to find price filter , like i wish to shortlist stocks price above Rs. 70 to Rs. 1200 , with my EMA scan , how to do it ?

This is quite easy to do, let me know if your facing issues even after going thru our video guide: https://www.youtube.com/watch?v=P77BMG_yGC4&index=1&list=PLpuk1PnOiN3CR8rgURuckWYuEtjjXLFiN

Hi Akash,

I got an introductory mail for scanner from chartink which says the scanner can be run for multiple time frames.

I couldn’t find how to get weekly or monthly candle runs. Pls advise.

Thanks,

Sachin

You can refer this video for the same: https://www.youtube.com/watch?v=xQoSP74IgPo&t=18s&index=3&list=PLpuk1PnOiN3CR8rgURuckWYuEtjjXLFiN

In your website, you have mentioned that weekly and monthly scanner options have started.

Can you post examples of the same?

Eagerly waiting for your reply.

You can refer this video for the same: https://www.youtube.com/watch?v=xQoSP74IgPo&t=18s&index=3&list=PLpuk1PnOiN3CR8rgURuckWYuEtjjXLFiN

Thanks for the reply.I had already gone through your videos before your reply.

they are of great help.

also thanks for adding Bollinger bands scaning in your scanner.

If you take practical for half day we will be greatful.

Also in point and fig charting we can not drraw any lines or erase any lines if any one is using ipad,

Thanking you

Gowree karve

Does the newly added videos help?

how to scan in weekly chart and monthly chart ? ….all scan is done in daily chart

You can refer this video for the same: https://www.youtube.com/watch?v=xQoSP74IgPo&t=18s&index=3&list=PLpuk1PnOiN3CR8rgURuckWYuEtjjXLFiN

open=low high volume,

fast candle range breakout

Hello Shailest,

Here is your required scanner, Kindly review it –

https://chartink.com/screener/open-low-high-volume-44

Hi,

Can you please let me know if the below scan is possible

60 min macd crossover results or

60 min bar crossing 20 sma above or below

Thanks in advance

As of now, only Daily/Weekly & Monthly scans are avaliable

Great progress. Couple of things..

1. Can we have a check box option so as to apply the scan only on the F&O scrips?

2. Also can have a feature to apply the scan only on the watchlist stocks? than the whole universe?

Thanks in advance

We currently don’t have a option of doing so, but shall be adding in future

Have you’ll added running the scan only on a watchlist? If yes can you guide? Thanks

Hello,

Your query is not very clear. Could you please elaborate more on it? Also, please share the screenshot of what you are looking for to review and respond.

How to scan from only Nifty 200 stocks?

Hi sir ….

Thks for all ur efforts for making this easier for inestors but

i want stocks consolidating for certain days help me to get it …….

Here’s a recent consolidation scan that I created: http://chartink.com/scanner/stocks-in-narrow-range-high-150-for-the-past-7-years

Hi Team,

Thanx for doing a good social service job. God always bless you for your work. kindly add buying and selling signal of the stocks for short term, mid term , long term and positional traders before starting of the trading hour.

Thanks,

Bubun.

You can follow one of our saved scans for short term breakouts: http://chartink.com/scanner/short-term-breakouts

When do we buy akashji

Can you make a scanner for candle stick pattern ” Hammer” bullish as well as bearish ??

Hi team,

Can I filter F&O Stocks?

Yes, there’s a option to change the segment: “Stock passes all of the below filters in cash segment :”, click on the “Cash” once on the scanner page to change it to “Futures” segment

How do I filter out Stocks less then Rs. 10 ?

Thanks

Here’s a sample scan that I created for you: http://chartink.com/scanner/stocks-less-than-equal-to-10rs

Thank you ver much sir for your quick reply

I think the scanner needs a tweak like say like I scan

“10 days ago CloseLess than 30 days ago Close”

it scans all the days instead of only “working days”

results are different on friday evening and different on Monday Early Morning.

please look into it, Thanks

On Monday, if you tried during Market hours, after 9:30am, the “latest” would refer to Monday, as Scans are updated during Market hour with a delay of 15 minutes

agree, but the “10 days ago CloseLess” line counts saturday and sunday aswel and narrow downs the results…

No, only Market trading days are considered, so, “10 days ago”, would include 10 market trading days(excluding all holidays). Can you give me a example scan for the issue you are noticing?

Thanks and Kudos to Chartlink Guys .. screener is very useful, keep it up for us..

Thanks for your feedback

i want to scan when tenkan sen cross kijun sen in ichimoku .please advice

Here’s the screener: http://chartink.com/screener/tenkan-sen-conversion-line-crossed-above-kijun-sen-base-line

Hi there,

I was trying to create a scanner so I can find scripts that opened HIgher then Yesterday’s High,

but unfortunately it gives wrong results

here is the link: http://chartink.com/screener/hh-1

am I doing somwhere wrong? please Help

Thanks

Sandip P

The scan that you shared, considers the close rater than the open. Here’s the correct one: http://chartink.com/screener/copy-hh

Thank You very much

Can you please guide me “Bullish Engulfing” and “Bearish Engulfing” candle stick pattern in live market.

You can refer this: http://chartink.com/screener/bullish-engulfing-pattern-1

Bearish Engulfing can be created in a similar way. Let me know if you have any doubts

Thank you sir.

But i asked not this.

I need engulfing patterns in the live market.

The scan that I shared, would have it results updated during market hours(15 minute delay). You can either keep the screen open and click on “Run scan” every minute to get the latest results Or just refresh the page

TataGloabal is accured 10:30 am Bearish Engulfing pattern that time stock price is 156.20.

Hexaware is accured 09:55 am Bullish Engulfing pattern that time stock price is 243

This type scanning needed.

The scan that I shared, would have it results updated during market hours(15 minute delay). You can either keep the screen open and click on “Run scan” every minute to get the latest results Or just refresh the page

I want to find stocks whose Latest Low is within 10 % from the bottom of the previous 5-day Max-Min range of High Low.

i.e I want to scan for [Today’s Low – 1 Day ago Min(5,Low)] Less than equal to [o.1 *{ (1day ago Max (5,High)-(1day ago Min(5,Low)}]

This requires bracketing to specify order and relationship of the arithmetic operations. I find I am not able to implement such a scan.

Here’s your Screener: http://chartink.com/screener/screener-for-p-ramakrishnan

Also, we have added “Brackets” as a function but we can skip that in this screener as operators are evaluated form left -> right

Let me know if you have any doubts

Dear Sir,

How to select BTST/STBT stocks?

I suggest you review our popular scans here: http://chartink.com/#top-scans

Which shall give you a idea on how to go about creating your own custom scans

Dear Sir,

How to identified sharp surge stocks?

Please guide me.

Dear Sir,

How to find out daily morning after pre-open time ( 9:08 am ) ichimoku span line above opening stocks?

pls guide me.

You can refer: http://chartink.com/screener/ichimoku-uptrend-cloud-crossover

Our prices are delayed by 15 minutes, so you’d get latest results at 9:30am IST

Dear Sir,

How to setup when the senkou span A crosses from below to above the senkou span B.

Thank You sir.

You can refer this scan: http://chartink.com/screener/copy-ichimoku-uptrend-cloud-crossover-rsi

Dear Sir,

Please setup Cci 20 cross above CCi 100 with Rising Volumes.

Dear Sir,

Will you please guide on making a scanner for stocks

1) above Rs 25

2) closes above its 30 days High

3) weekly or Monthly High Volume

Thanks

Sanjay

………

1) above Rs 25

2) closes above its 30 days High

3) weekly or Monthly High Volume

4) 2 days ago close less than 30 days ago

5) 3 days ago close less than 30 days ago

6) 4 days ago close less than 30 days ago

7) 5 days ago close less than 30 days ago

8) 6 days ago close less than 30 days ago

9) 7 days ago close less than 30 days ago

Have you tried adding the filters that you’ve mentioned in our scanner?, here: http://chartink.com/screener

Hi. Could you please help me getting a scanner for stocks given Positive results from Negative results on QoQ and YoY basis

Dear Sir,

Just wanted to know what is the time delay in chartink scanners to that of the live market???

We have a 15 minute delay for the stock prices on NSE

Dear sir,

Chartink is superb website. We are identify stocks every time refresh website, otherwise you can provide any SMS service for our scanning pattern.

We’ll be launching an alerting system soon

Dear Sir,

how to find out below 50 dma stocks?

You can refer this screener: http://chartink.com/screener/200sma-crossover

And change 200 to 50 to get a 50 day SMA/DMA

dear sir,

what is the meant of Latest Open Greater than number * 0.01

If the open is 100, “Latest Open Greater than number * 0.01” you mean, the open is greater than the number * 0.01, if you put 100 in place of the number, it would be 100 * 0.01 = 1 ( 100 > 1 )

Hello Akash,

Kudos, brilliant website, really very useful, thanks!!

On EOD basis, I want to scan those stocks which are in a 2% distance of the 20D High / Low and 55 D High/Low.

Also I want to scan those stocks which hit the 20D and 55D high /low in today’s trade.

Thanks in anticipation!!

Thanks!!

Thanks for your feedback. Kindly refer this scan: http://chartink.com/screener/stocks-which-are-in-a-2-distance-of-the-20d-high

You can change 2% with (1.02) or 5% with (1.05) number value.

This is the best site for screening of stocks. Using this site we can screen stock considering daily time frame. My request is, can u add weekly time frame also. Like, weekly macd cross over, weekly over sold, weekly moving average etc. That would be very helpful for long term investors.

Weekly/Monthly ranges are already provided, kindly refer this example: http://chartink.com/screener/weekly-rsi-overbought-oversold-scan

how to choose time frame while building a filter

Hello,

You will get the filter option by clicking on the “+” sign. You can click on any one of them as per your scan requirement. You can observe that “Latest ” is the default timeframe that will be chosen.

You can click on “Latest” to select your required timeframe. You will get the options in the dropdown list.

I hope this helps.

your site is doing a wonderful job Cheers!!!….I just had a query, the site says ‘Custom Scans now updated during market hours’, what is the estimated time lag for updating the charts as compared to actual market??

Its 15 minute delay for the latest price (candle)

thanks buddy, God bless you!!!

Is this time lag there for premium/paid users as well ?

Free version data is delayed by 5 minutes. In premium subscription, charts and scans are updated every minute. Our premium members get realtime data with updates every minute for our Charts & Scans. So if you run a scan at 9:20am for example, it would be based on the latest data until 9:19:59am and so on..

pls improve delaytime in data from 15 minutes to 5miutes so that its more beneficial for trader as well as investor.

Could you please change the ATR formula and Display similar to the following site:

http://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:average_true_range_atr

– as there is a difference in calculating the end number with respect to other sites.

It is wonderful . Please keep it up. Suppose I create a scanner viz open = high and run it by 9.30 am, will it show the current day details ? Is it possible to provide EOD Heikenashi charts in your charting platform? That will be very useful. Good job and carry on . All the best to you.

You should get the current day’s data by 9:25-9:30am daily (as we have 15 minutes delayed data from NSE). We’ll be adding “heikenashi ” soon in our EOD charts.

how to find stocks nearing (or just crossed) all time high price.

Here’s your scan http://chartink.com/screener/stocks-at-lifetime-high

We have more than 12+ years of data in which you can scan

Thank you

I want to create a scan, which should give current monthly RSI is greatest in past 12 months.

As per your guide lines, I have written the following formula.

Monthly Max(12, Monthly RSI (14)) equals Monthly RSI (14)

Is the above formula is correct ?

If I am wrong, kindly write a correct formula for me.

Thanks in advance.

Bhushan

You scan is correct, we have more than 12+ years of data in which you can scan

Akash Sir,

Thanks for the reply,

Bhushan

Is there any way to use close price even when scan run during market hours, I don’t want to use current prices, instead want to refer yesterday close always, so if I run after current day mkt close then it should use current day close otherwise should refer previous day close price? is it possible?

You can refer to yesterday’s close as “1 day ago close” to do this

but if i use “1 day ago close” and run same scan after mkt close then won’t it refer previous day close, while I want it to refer current day close when run on current day after mkt close.

Yes, currently that’s the only way possible.

We’ll be soon adding a date filter, allowing you to run the scan as per a given date(the latest would refer to the data as of the given date)

Adding date would be a great advantage so please add i soon

Yes, we shall add them soon

This is one of the most comprehensive filter tools available for free at the moment. Great job!

I did have one question though. After running my scan, I am given a few columns most of which are unimportant to me, while the important columns are missing. Do you guys allow customization of the columns on the Result Table?

Thanks.

Currently there’s no provision to have custom columns. We’ll plan on adding that in future though. Any specific columns you are looking for?

In my primary custom scan, I would like to mainly have an RSI column.

in scanner,it is returning close price. I want to have open price also

How to scan stocks making higher highs?

You can refer this scan: http://chartink.com/screener/stocks-at-lifetime-high

Dear Sir,

website not updated why sir?

Pls update website immediate sir.

we are miss wonderful website.

Dear Akash,

Thank you so much for this lovely website, I refer this website to many to use it.

Please include Triple Exponential Moving Average (TEMA) for a Customized Scanner as an indicator along with Exponential Moving Average (EMA).

Thank you,

Regards

Vishnu

Dear Akash,

Thank you so much for this lovely website, I refer this website to many to use it.

Please include Triple Exponential Moving Average (TEMA) for a Customized Scanner/Screener as an indicator along with Exponential Moving Average (EMA).

Thank you,

Regards

Vishnu

We shall add TEMA soon

Dear Akash,

Thank you so much for your response. Eagerly waiting to see Customised TEMA in Scanner & Screener.

Warm Regards

Vishnu

Hi Akash,

Can I expect TEMA in updates on Scanner/Screener by this month end? It would be a lovely tool to work on as compared to EMA. Kindly update ASAP. Thank you so much.

Regards

Vishnu

We are working on adding more indicators along with TEMA, I can’t commit on a date yet as we’ve prioritized our user’s feedback by the most received ones, but in the next few weeks we shall add that. I would surely keep you updated on the same.

Can you please provide an update on this?

chartink is a great website after started using my trading methodology has changed totally, thanks for the team.

I do have a question what is the difference between crossed above and greater than on closing basis because I’m getting two different results I couldn’t understand

Thanks for your feedback. “close crossed above 50” means the close was below 50 yesterday and has closed above 50 today(indicating a crossover).

Sir,

What is the difference between “7 Days ago” and “1 week ago”

as when I put this line >

“Volume” Greater than “7 Days ago”

and

“Volume” Greater than “1 Week ago”

the results are different…

Thanks

“n days ago” refers to daily candles whereas “n weeks ago” refers to the weekly candles. You can change the range of the candles shown in our EOD Charts from its default to “daily” to “weekly” or “monthly” and refer these candles within our scanner with “n weeks/months ago”

Dear Sir,

It is a Marvelous Charting tool, Thanks a lot

my doubt is in editing “How to insert new line in between”

Regards

Ramnagaraj

“How to insert new line in between” is this question in regards to the scanner? Can you explain more on this

How to set macd indicators sell & bay for 5mint can6

Below is an example scan on MACD crossover on 5 minutes candle:

https://chartink.com/screener/macd-line-crosses-above-macd-signal-3

sir, when using ema crossover scan it gives me name of a stock but when i look that stock on zerodha kite it shows no crossover has happen. why is that

I’ll suggest you verify the crossover on our charts. For EMA we considering datapoints for more than a year, I’m not sure how its done in other charting sites

Hi Akash,

How can we know a Crossover instantly? Is there any method to detect crossover immediately?

Regards

Vishnu

You can run the scan during market hours to identify crossover that happen while the markets are open (data to the scan is delayed by 15 minutes same for the our Charts)

Dear Sir,

Pls setup 3% high, low compares previous close.

Dear Sir,

i want to scan the stock which is very low changes in price

for example stock x day 1 .. open 82.05 high 82.10 close 82.00 low 81.90

day 2 .. open 82.10 high 82.15 close 81.95 low 81.85

You can create the filter based on the % of difference form its day’s high

Sir

Suppose i want to use 5 min , 15 min or 1 Hr candle stick charts

then how to filter the stock base on above charts

For example: i want to filter stock whose 1 Hr close is above the ichimoku cloud then how to filter the same. same condition with 5 min and 15 min charts

We don’t have Intraday time frames yet

First I would like to thanks the Chartink team for doing the wonderful job you people have done for Indian investor by developing the new customs scans.

It has really helped us to scan the stocks based on different indicator or oscillator. I would hereby request you people to please upload the Heikin Ashi charts and the scan for Heikin Ashi Bullish and Bearish Engulfing pattern. As they provide to be good indicator of trend reversal.

Thanks for your feedback. Sure, we shall plan on adding that soon

Dear Sir,

Please guide in making Narrow Range 7 (NR7) scanner

Thanks

Shankar

You can refer this scan: http://chartink.com/screener/nr7-improvised

Hi ,

Can you please help me in getting the consolidation zone for the shares. How to scan for the shares getting consolidated ,I mean bouncing between a support and resistance level from say 2-3 months.Thanks for the help!

Regards

We have created 2 scanners for these

http://chartink.com/screener/short-term-breakouts

http://chartink.com/screener/potential-breakouts

Team,

I am looking a scanner 20 days cross over with 200 week candles. Please assist

regards,

Binny

Hi someone please help me create a scan from stocks trading above 50 weekly moving average and below 50 weekly moving average thanks

Hello,

Sure, below are the links to your scan. You may make another scan for trading below accordingly.

https://chartink.com/screener/close-greater-than-weekly-50-moving-avg

hi

can some one help me in creating 2 weeks average low value

(sum of 10 days low / 10)

Below is your scan:

https://chartink.com/screener/2-weeks-average-low-value-sum-of-10-days-low-10

You are looking for 20 day high cross above 200 weekly candles?

sir is there possible to use( OR ) condition in scanner like this’

A and (B OR C and D and E)

time frame 30 min or any INTRA DAY

A =(0 candle latest close > 1 candle high )

B=(1 candle close is 2 candle close)

D=( 2nd candle close <3rd candle close)

E=(1st candle close <2nd candle hidh)

so sir please guide me that as how to apply OR in above query .

if possible than please send me

Yes, you can have “AND/OR” condition by specifying stock matches “ANY/ALL” conditions. Here’s an example scan using OR condition: http://chartink.com/screener/macd-bearish-or-bullish-crossover

I could have created your scan, but was unable to find what the C condition was, let me know if you have issues in creating the scan now

sir please give me your contact no so i will explain you condition.

Can we have a complex composite of AND/OR ??

LIKE

(condition 1) and (condition 2 OR condition 3)

Hi,

i was trying to get the below results. tried various combinations,, not sure ,

4 hourly chart EMA above 50

1 hour chart ema above 50

5 mins chart ema above 50

Please help

Here’s your scanner: http://chartink.com/screener/stocks-above-ema-50-in-1-hour-and-5-minute-chart

Currently we are still in the process of collecting data for 4 hour chart, so add the condition after 5 days so that we have 50 candles available

I want only amt display 490 590 690 is it possiable

Dear chartink team

I am using your scanner to filter out stocks and very happy to get this service that too free. I am very much thankful to you for the excellent service.

Now my question is intraday time frame m5/m15/m30/h1 are live or delayed data?

Thanks for your feedback.

Intraday data is delayed by 15 minutes, the same for our Charts & Scanner

Sir please turnover option in filter to calculate VWAP

VWAP is also imp indicator so please add turnover option in filter

I have applied this filter

Latest 1 hour close crossed over super trend of various parameter but result are not as per filter

Please let me know whether I am applying wrong filter or something else.

Kindly ensure that the supertrend is based on the 1 hour time range as well

I want only amt display 490 590 690 is it possiable and last month close and 5 days avg volume greater then 20 percent ok give me reply

Kindly explain what you mean by 490 590 690

How to take daily traded value as filter??

You can do “volume * close” to get the daily traded value

sir how ( or ) relation work if applied on 3 or 4 condition on single screener.

A= weekly current close is > one week ago high

B= one week ago close > two week ago close.

C= two week ago close > three week ago open.

D =(0 candle latest close > 1 candle high ) ( 30 min candle)

E=(1 candle open is > 1 candle close) red candle ( 30 min candle)

F= (1 candle close is > 1 candle open) green candle ( 30 min candle)

G=(1st candle close 2nd candle close) ( 30 min candle)

above condition in bellow relation for single save screener =

A and (B or C) and D and ( E or F and G and H)

sir please please make such screener.

You can use “Sub-Filters” to have AND/OR condition, here’s a example scan using them: http://chartink.com/screener/futures-crossover

Hi i want to scan only nifty 50 stocks how to do that

We currently don’t have a group of NIfty 50 stocks, we shall add that shortly

Hi Akash,

Once again, thanks a million for providing one of the best scanners available in the market; that too for free.

Had a request that would help a lot in intraday scanning, i.e. selecting “Today” Candle for Intraday Scans.

Please consider implementing it, that will take away need to duplicate code/criteria setting many numbers of time.

In order to explain my request more specifically as to how “Today” option can help reduce writing similar code numerous time in Intraday Scan; currently, there is option of 0,-1,-2,-3,-4 and so on for Intraday times i.e. for 5, 10, 15, 30, etc. So in case of crossovers during any intraday time frame right now we need to define every candle from that time frame to identify the crossover. But in case if “Today” option is available, then it would be fairly easy to define crossover for any intraday time frame through one line code as against per candle. I hope I have been able to explain my point.

Thank you very much, Akash.

Thanks for your feedback. I understand your query and we shall soon be adding a “as of date” filter, to run your scans as of a given date rather than the default of “Today”

Cheers !! Akash 🙂

Hi Akash, Any update on this request? As this would provide real good benefit for intraday scanning.

We’ll be releasing this soon. I’ll send you a update over mail

Can u pls tell me if it’s possible to find which stocks gave a bullish supertrend in the 15 mins or 1 hour timeframe charts?

Also is it possible to find out which stocks rsi crossed 50 in 15 mins or 1 hour timeframe charts?

I need this real-time during market hours. (15 mins delay is ok)

If yes… Please provide the scanner formula.

Yes, here’s a example: http://chartink.com/screener/supertrend-sellll-55555-min

today i scane for http://chartink.com/screener/daily-buy-8 .

daily ema 100 is less than 50 or daily ema 20 is less than 14 it gives in result m&m and lichsgfin though both are is sell ( with respect to above mansion ema daily ) . sir pls reply

I’m unable to find them in the resultset now. Kindly confirm if you are still facing this issue

Could you please add EMA based Keltner Channel with ATR band as style as an indicator, also add the same available in the scanner as well?

Bro Jayesh here (9370700600) i also wanted to create one scanner which based on ATR bands and ema with Heiken Ashi candle

Pls contact if you can help

Hello,

Currently, all indicator-based scans are run only on Candlesticks and not on Heikin-Ashi candles. Hence doing this for ATR won’t be possible. You can add the EMA with the Heikin-Ashi candle. Here is an example scan below for your reference:

https://chartink.com/screener/ema-9-crossing-above-ema-21-on-heikin-ashi-candles-daily-timeframe

Excellent work… One request…. needed data filters for other time frames..

You can refer our F&O for this: http://chartink.com/articles/scanner/stock-screener-faq/

Akash sir ( team chartink) thank you very much for making such very useful tool and quick reply for any query . sir i have few addition if you feel considerable 1) add open interest data 2) same technical tool with fundamental data for scan as like in screener.in 3) make it live real time chart and auto refresh live scanner ( obviously WE READY TO PAY AFFORDABLE CHARGES )

NOTHING IS FREE IN THIS WORLD WHICH IS PRECIOUS EXCEPT CHARTINK.COM.

Today i thing site is under maintenance as scanner not showing result from noon to till now evening 6.30 pm , SIR PLEASE I REQUEST YOU THAT DO MAINTENANCE AFTER CLOSING MARKET.

THANK YOU CHARTINK TEAM.

Thanks for your feedback. Yes, we are working on additional fundamental fields within our scanner. Also, we shall avoid maintenance during market hours in future

thank u sir for your reply …..in chartink there was cross over so its seen in screener … i think some difference in calculation of super trend . but no problem i love chartink.com. my all time best website. lots of star for team*************************** thanks .

Dear Sir,

Thanks for very beautiful analytical tool, Want to know when can open interest parameter can be added in scanner.

Hello,

Currently we support only NSE cash stocks and indices. We do plan on adding others in the future. Shall keep you posted.

ok now working sir.

hello sir , today i face problem regarding hdfc bank 60 min chart as it shows price is cross super trend 7,3 upward but when i check on other online chart like sharekhan and tredercokpit super trend is still bellow prize. is there any problem with super trend formula data calculation . pls reply

Kindly verify the crossover within our charts here: http://chartink.com/stocks/hdfcbank.html

I’m not sure the formeulea used by other sites

akash ji how to screen the stocks on 5 minute time frame.

(5 min candle low value is greater than 5% of Bollinger band upper band line.)

Hello,

Here is your scan for the same:

https://chartink.com/screener/low-greater-than-upper-bollinger-band-by-5-5-minute-timeframe

wow, what a superb tool for traders and investor…..I feel blessed to find this website with screener and hessel free / convenient. Cant believe life can be so simpler and without spending a penny for the same.

FIRST OF ALL ITS GOOD TECHNICAL SCANNER !!

is there any delay during live market ? I want to scan first 5 min( 9.15am to 9.20am) tick so can i scan at 9.21 am?

There’s a maximum delay of 5 minutes & a minimum delay of 0 mins, data is updated every 5 minutes, so if you want to scan for stocks between 9:15 & 9:20, run the scanner around 9:21am.

Hi Akash,

Please explain me, how to use ‘Buy orders Vwap and Sell orders Vwap.

Your design of the website is superb …..I have few requirements, please let me know there feasibility.

1) Back Testing.

2) Multiple watch lists or grouping of stocks in watchlist

3) Adding stocks to watch list from scans

4) Bar Count function which can compared.

Ex :: Bar count (EMA50 Crossed EMA200 last time) > 10

5) Max and Min functions accepting expression as inputs for number of bars

EX :: Max( Bar count (EMA50 Crossed EMA200 last time) , High)

6) Date at particular event

Ex :: DATEAT(HIGHVALPOSSINCE(RSI(14) crossed above 30,HIGH,1))

7) Max and Min values since a particular Date,Date can be arrived by Date function.

Hope i’m clear in my requirements.

Please respond on each point on feasibility and by when can we expect.

We have recently added the ability to have multiple watchlists and run scans from a particular watchlist.

I read thru all your inputs and many of them sound good, we shall try implementing your inputs in the coming few months

Sir, Is it possible to BackTest our scanners so that we can be sure whether that scanner is good for the selected stock or not?

If that is possible, please guide me how to use that.

Thanks a lot in advance.

Currently you’ll need to manually change the “latest” to n days ago to backtest your scans, we shall soon be adding the ability to run back dated scans

Chartink is a very good website

I want to know if intraday data is real time or delayed?

Akashji, how to start adding selected stocks in Watchlist group?

Once you’ve registered, you can go here http://chartink.com/watchlist_dashboard and starting adding stocks to your watchlists

Hi Akash,

Have noticed that scans that are NOT marked as Public are also appearing in the suggested Public scans list (Related Screeners List that appears below scan results). Request you to please check and fix it if you could.

As always, appreciate your contribution to the community.

Regards

Sameer

Sure, I shall look into this

Hi Admin,

thank you for such a great screener, i have a problem finding values how to screen some thing like this … 20 SMA is 5% greater that 50 SMA and 50 SMA is 5% greater than 100 SAM kindly explain thanks Shahjahan

We have many such examples for stocks near SMA/Highs, I’ll suggest you review thru them here: http://chartink.com/screeners/search?search_term=near

hi,

when BSE EOD data will be available for writing analytics.

thanks

ankit

Probably in the next couple of months

Hi akash, Greetings.

it would be helpful if we can add multiple stocks in watch list at a go…can we do it in present scanner.

This is possible, we’ve just added the ability to have multiple watch-lists’ and use them in your scans

Hi Akash,

Your scanner works superbly, need your help as mohamed also asked for, need to add multiple stocks in one go in the watchlist, currently we have to search the stock and then add to the watchlist, what if we can add the mutliple stocks in one go in watchlist, instead of adding one by one.

Thanks

is it down at present?

We had scheduled maintenance activity ongoing, things should be working now

Thanks for Mutiple watchlist.

Please look into providing option to bulk upload Stocks into this screeners from EXCEl or CSV or like google finance upload option where we can copy and past mutiple stocks in search box and we get all this stocks added into watchlist.

Sure, sounds good. We shall ad this in our todo

Thanks for Picking it up.

I like the way you are ready to adapt to user requirements and update. Great Job

One more thing i want to highlight

-You would be saving all the requirements that are coming from users,If you can publish the todo list of changes, it would be of great help for us to Understand what is coming and people also can give suggestion once we have the view of list.

Sure, we’ll add a feature tracking system, probably using JIRA to help user’s keep a track of todo items and vote for them

how to create candlestick / pattern scan..?

for eg. last candle should end with a Hammer , ( or other specified )

You can browser to various candlestick patterns here: http://chartink.com/screeners/candlestick-patterns-screeners

You could either search existing ones or create a new one matching your own criteria

Akash,

Thank you very much for providing such a wonderful screening ability, I am in process of creating 15 min ORB scanner , I need list of stock when it break first 15 min candle anytime during the day. Could you please help me here

I recommend you review a few ORB scanners here: http://chartink.com/screeners/search?search_term=orb

Thanks Akash for quick response. I looked all the ORB scanner but I am still not able to understand the logic how first 15 min ORB scanner works when price breaks 15 min range any time during the day, how we can capture the first 15 min range in query. e.g stock ABC first 15 min range (9:15-9:30) broke on higher side after 12:30 how should I write such query as offset is not known in advance(it can be anytime any candle after 9:30). I look all the query but coundnt find. Following query looks interesting but not sure if it will do the job or not

LatestCloseGreater than[-1] 15 minuteHigh

so if I run this query at 12:32, it will give me only those stock where latest price at 12:32 is higher than 12:15 candle.

Correct me if I am wrong and help me in capturing first 15 min range in query.

I also heard from someone that you have paid services with more advance future but I coudnt find any option can you provide me more detail on that.

Thanks,

You correct, currently to refer to the first 15 minute candle of the day, you’ll need to manually need to specify the offset -5 or -10 depending on when you are running the scan during the day, we shall be soon adding a function to help you with this.

We plan on having premium services providing alerts via SMS/Email along with a additional features, we are in the process of finalizing it, once done, I’ll surely share the details with you

Thanks Akash, please do let me know once you have premium service specially alerting feature.

Sure, i’ll keep you updated

Akash ,

What is the latest close while markets are open. If I use latest close and intraday offset e.g [-1] 5 min close, how latest close will work here

Thanks,

Ashwin

Latest close shall refer to the CMP whereas, -1 5 minute close refers to the previous candle on a 5 minute candlestick chart. So, if the current time is 12:30pm, “latest close” equals “12:30pm” & -1 5 minute refers to the close at 12:25pm

Thanks Akash for detailed explanation so If I use ** Latest close and [0] XX minute close **** both would refer the same price, right ?

is this correct understanding ?

Thanks,

Ashwin

Yes, you are correct

Cool, if I use volume instead of close with latest and [-1] 5 minutes than , latest volume shall give me day volume till point and [-1] 5 shall give me previous 5 minute volume, please confirm?

Yes, correct

Hello Akash …i have question related to intraday scanning…suppose i want to scan SUPERTREND crossed below first 5 min candle in live market at around 11AM its difficult to scan such situation as I have to count number of 5 min candles on chart and then replace this count no in place of

[0]5min….instead it would be of great help if we can replace [0]5 min with time like 9:15 candle crossed below 5min close

Yes, we don’t have a function for the same recently, so the only way possible is to count the no. of candles backwords until 11 am. We’ll soon making on adding this thru a function

Hello Akash

Is this functionality of getting results for a particular point in time available?

I want to find the Highest of the Highs between 1:39 pm and 2:15 pm.

Currently we can plot the same on Atlas dashboards. We can check for a stocks high within a particular time frame

Hi,

I was trying to create a crossover for Stochatic for latest crossovers. I have created below scan, but it does not seem to give the correct data. IT shows crossovers which are older like 15 or 20 minutes back

Stock passesallof the below filters in cashsegment :

LatestSlow Stochastic %K(10,3)Crossed aboveLatestSlow Stochastic %D(10,3)

Modify parameter

I’ll recommend you verify the breakouts within our Charts, as the formulea used should match with place you are viewing the breakouts in scans.

Hi Akash,

Wonderful efforts, best scanner seen so far.

Need your help in creating new scanner with the following

5 Day Absolute Price Change > 100 Day Standard Deviation

5 Day Average Volume < 75% of 5 Day Average Volume

The first filter wouldn’t be possible as of now as we don’t have a std deviaation function. For the sencond condition, did you mean 10 days avg volume < 75 % of 5 days avg?

Thanks admin, i would like to screen some thing like, the prices are ranging between 20% to 30% for past 6 months. also kindly do let me know about the use of bracket value and how to apply it.

thanks

You can achieve the same using our min & max functions to help calculate the range of price for the past 6 months

Hello sir,

Sir i want to creat a scanner in 1hr chart in which cmp close above previous higher high in buy side and in sell side cmp is close below previous lower low. Please help me.

Thanks.

How would you define “previous higher high”, is it the past 10 candles on a 1 hour timeframe? Or more

Hello sir.,

I mean to say that previous swing higher high and swing lower low in 1hr chart.

Here’s an example: http://chartink.com/screener/swing-high-scanner

You can change 5 minuet to 1 hour to get a similar behaviour

Yes i got it

Thanks Akashji.

Hi Akash,

Aren’t these two quires same? Why am I getting different result set?

Query 1:

Stock passes all of the below filters in cash segment :

Latest Close Greater than 1 day ago Close

Latest Close Greater than 2 days ago Close

Latest Close Greater than 3 days ago Close

Latest Close Greater than 4 days ago Close

Latest Close Greater than 5 days ago Close

AND

Query 2

Stock passes all of the below filters in cash segment :

Latest Close Greater than 1 day ago Max(4,1 day ago Close )

Your second query, should be:

Latest Close Greater than 1 day ago Max(4, Latest Close )

As we want to refer to the current close for a day within the max function

Dear Akashji,

I want to create a scanner for a list of stocks which have crossed the 200 EMA in the 5 day 5 min chart today. Also today’s volume should be higher than yesterday’s volume. Also can i get live alerts for the same on my email. Please help in creating the same.

Hi Dipesh,

Created scanner for your requirement.

http://chartink.com/screener/5-day-5-min-200-ema-crossing-for-dipesh

Akash recently, mentioned Email / SMS alerts will be rolled out in the near future.

//Mohan

Dear Mohan,

Thanks for the screener.

Just wanted to know if i run the scanner at EOD, will i be able to get the list of all the stocks that have passed through the screener today.

Yes. Infact, even if you run it during trading hours, you’ll get the latest results of the trading day

Dear Akash

I really like the way you are assiisting us in various queries

I need your help to set up a scanner for BUY volumes over a period eg last 5 days or last 4 weeks

Regards

Dhiren

You’d first need to identify what conditions/filters would identify a stock with increasing BUY volumes, would it be closing positive with rising volumes? OR close up by a fixed % over the last few days

Dear Akashji,

I have created one screener in which the parameters is weekly CCI crossed above 0. If any day i miss the screener and if i want the results of the screener on any other day how can i get that?

We’ll be adding a date condition soon to help you run the scan as of a particular date.

I discovered the website today. Registered and created a few filters/scans. Impressive. I would like to know how to confine my scans to Nifty 50 or Nifty 100. Please guide.

We have this documented within our FAQ, here’s the link: http://chartink.com/articles/scanner/stock-screener-faq/

Notice the watchlist questions, you’ll find nifty 50, 100 in the same dropdown

HI ,

Can i know how to use this tool for macd crossed above 0 signal

You can refer this scan: http://chartink.com/screener/macd-crossed-above-signal-line-1

Hi,

Charts are static as of now.can you please provide

1)Date range option on charts(Ex :: want 1 year daily candles starting from Jan 2016 to dec 2016 only)

2)Horizontal movement of chart to view last 5 years data with constant page layout

this will be helpful to validate strategy on past data.

Yes, these are on our todo list & we plan on implementing this soon

Hi Akash,

you where about to share the todo list in the form of Jera Link.can you please share that

It was probably over the mail I guess

Over the mail also fine,can you please share it

Reminder…… can you share me the list

Can you suggest any available scanners or how I can create a scanner to filter stocks with 45% slope over last year or couple years ? For eg, to filter stocks like Bajaj Finance, Vakrangee who have a consistent upward graph for last year/s ?

You could use a min function on a monthly timeframe and check if the minimum % gain in a month is more than 5% every month for the past 1-3 years

Thanking you very much for creating so much useful site. Please let us know if you start any premium services.

Is it possible to get a screener for Double bottom chart?

Sure. You can refer Double bottom stocks here: http://chartink.com/eodscanner/Double-Top.html

Sorry. I need the formula behind screener so that I can edit as per my my need. That link is giving directly screened list.

SIR,

I reqest you to put VWAP indicator in this scanner because its a very useful indicator for intraday trading, it gives very good signal for up or down trend.

HI ,

I want scanner for PIN BAR 1hr duration both positive & negative .

means 9.15 mkt starts ,i want to see pin bar at 1000hrs (positive ) & negative botyh seperate means 2 scanner.

pls guide .

rgds

anand ahuja

Refer PIN BAR scans here: http://chartink.com/screeners/search?search_term=pin+bar

hi sir

i want intraday scan of 15 min time period for FNO stocks

1) stocks crossing ichimoku cloud above and below

unable to set scaner kindly guide

Excellent Tool. Why not provide for a simple import csv feature for watchlist ?

We have that in our to-do list

when you are planning to implementing this ?

Hi,

As of now i can make markings on Charts and save that externally, but do you have any plan in implementing saving of studies online so that when i open that chart again, i can see my markings with new candles data.

Yes, we plan on allowing that soon

Hi,

One more thing.

On 30 min chart your first bar is from 9:15 to 9:45 and last bar is from 3:15 to 3:30 right

Can you change this to first bar is from 9:15 to 9:30 and last bar is from 3:00 to 3:30.

As most of the charts that i use have that format(Google Finance,Moneycontrol, Traderscockpit etc)

Could you please look into this.

We’ve kept it starting from 9:15 because Indian markets don’t open at the start of a hour, most of the markets world-wide start from the start of a hour(eg: 9:0am). The calculations from 9:15-9:30am wouldn’t be accurate enough to consider in a 30 minute candle period

But if select [0] 30Min in you screen after market, it is considering 3 to 3:30 PM, but once we open chart, we have bar from 3:15 to 3:30 only, its confusing

can you move as requested above

Dear Akash

Thanks for your revert on my query about rising volume. I will be interested in closing positive rising volume.

Dear Akash

I notice that when I use the below query “Weekly CLOSE crossed above SMA (Close, 20)” it does not give me the closing price above Middle Bollinger band. What is the problem with my query??

Thanks

Dhiren

If you want to refer to the WEEKLY Middle bollinger band, use the below filter instead

Weekly CLOSE crossed above WEEKLY SMA (Close, 20)

Dear Akash

I want your help to define a query for positive volume ie increasing volume over a specific time frame ( daily, weekly, monthly). I have tried using moving averages but cannot achieve the desired result. Thanks

Dhiren

Hi ,

I need some help in writting below code

On a 30 min chart apply RSI and 50 EMA, now i want to know all stocks that met below criteria

1) close of any 30 min bar today should have crossed below 30 min EMA 50

2) MAX RSI value between (bar closed below EMA 50) and (bar closed above EMA 50 before to this closing below EMA 50) should be 70.

In other words,

Stocks Close should have crossed below EMA 50(of 30 min) today for the first time after RSI has crossed below 70(this can be today, yesterday or so on)

Hi ,

I am looking for simple moving average (SMA) 9 crossingover SMA 20 in hourly chart and in monthly chart.Could you please help?

Also is it possible to get the latest date which it crossed over?

I’ll suggest you search thru our SMA crossover screeners here: https://chartink.com/screeners/search?search_term=sma

yes it is possible

Hi ,

‘RNAVAL’ is missing from Futures watchlist.

Thanks for notifying, this has been added

Dear Akash,

How can i scan the stock’s 15.min close crossed above 200 Sma during live market any time or at the end of the day.

Please refer this example: https://chartink.com/screener/15-minute-stock-breakouts

I want to develop code for today’s RSI is greatest for last 1 year?

How to develop this code ?

Thanks in advance.

You can use the min/max functions for this

Can you create the same for me.

I have not understood the how to use minimum and maximum formula fully.

can we use this scanner in live market? I want to know about Any delay for the data?

Yes, we provide near real time data updates, more details here: https://chartink.com/articles/scanner/near-real-time-updates/

It is seen that, the stocks filtered are in a massive lot, one can not find out the stock added in the list very recently,it is missing and not possible to find out from the mass list. how can we find out the stock time wise or number wise?

what is the formula can be used to find out the stock running now day’s very low or high in 10 minute chart?

We’ll be adding the ability to show the recent stocks soon

Anybody will suggest for short term 10-15% gain in stock for very short term.

thank you.

You can refer the below 2 scans for short term

https://chartink.com/screener/short-term-breakouts

https://chartink.com/screener/potential-breakouts

How to screen moving average cross on the basis of hlc/3.

It is showing only open, close, low and high price.

Please guide. Thanks

You’ll need to manually calculate “high+ close+ low / 3” using the mathematical operations

Can you create the scan for stocks, which has moved up between 5 to 8 percent after creating 52 weeks low.

I have tried with using minimum and maximum function, but not able to used it correctly.

Can you create the one for me ?

Thanks in advance.

Yes, refer the potential breakout screener for this: https://chartink.com/screener/potential-breakouts

Hi Sir,

My requirement is last 26 weeks of ATR 21 value is below 20 and latest ATR 21 is crossed above 20, I tried it but it showing different values please guide me. https://chartink.com/screener/copy-ds-weekly-atr21-above-10-4

You’ll need to use the max function for this, I have created your scan here: https://chartink.com/screener/copy-atr-21-2

sir is it possible to create scanner like

1- prize current or latest close

ABOVE OR ( GREATER THAN OR EQUAL TO)

vwap ( volume weighted average prize)

2 – prize current or latest close

BELLOW

vwap ( volume weighted average prize)

We currently dont have the vwap indicator, but we plan on adding that soon

I’m a beginner I daily visit ur site for analysis 1.can l have the signal line for RSI that is EMA for RSI. 2. I want to learn swing trading how can u help me 3. Tell me about interperting P. F. chart and RENKO CHARTS(is it available).

I’ll request you review our scans here: https://chartink.com/screeners

It contains a lot of examples and is similar to your requirements

Dear Sir,

Requesting you kindly add PASS ANY SUB FILTER facility in filter section, which will give great output for all traders.

We have this present, kindly refer this guide: https://chartink.com/articles/scanner/scanner-user-guide/#sub_filters

I want to scan stock close above and below 26 day simple moving average with +7 days displacement.

can u share how to do it ?

You are looking for a 26 SMA crossover 7 days ago?

Yes Sir, 25 days simple moving average with 7 days (displacement)

Its Called display moving average

Here’s a example for that: https://chartink.com/screener/displacement-moving-average

Nice website very helpful for deeply analysing charts

Thanks for your feedback

Sir How to Moving Average Crossover Strategy

Here are some examples: https://chartink.com/screeners/search?search_term=moving+average+cross

sir is it possible to create scanner like

SMA 50 cut by any 15 min candle

Yes, you can use combination of filters like:

Latest SMA(close, 50) crossed above 15 minute close

hi sir

i want to screen out stocks based on OBV breakout in recent 6 months. But there is no OBV option in indicators of screener.But it is in charts . So pl. add OBV in screener.Also tell me how to make screen for that.I am living in rural part of ratnagiri district maharashtra.So pl. help me

I’ll suggest you refer some sample scans on OBV here: https://chartink.com/screeners/search?search_term=OBV+

Pls provide “Previous Day/Week/Month High/Low” indicator. This indicator should draw horizontal lines for the 3 highs & 3 lows in different colors. We should be able to select/deselect any or all of the high/lows.

Thanks

Sure, we’ll add this in our todo list

Sir,

please let me know how can i scan stock close above & below 25 days Displaced moving average with 7 days displacement.

Here are examples on displaced moving averages: https://chartink.com/screeners/search?search_term=displacement

how can scan close prize 3% above his 200 daily moving average

Refer this scan: https://chartink.com/screener/jttimes-stocks-near-200ma

It checks stocks near 200 SMA plus minus 2%

Hi

I would like to find the whether the volume of the current candle is greater than the average volume of past n candles

will this work ?

Latest Volume > sma(Volume,n)

Thanks

Hari

Yes, this is correct

I have below scanner and wants to know the diffference between crossed above and greater than. Looking as the name, seems both will give same result but they are not.